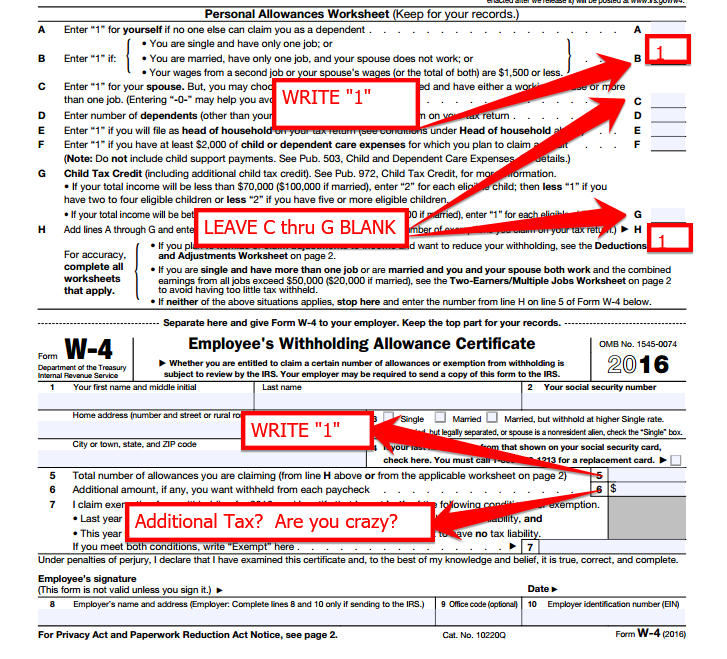

How To Do Deductions On W4

Deductions w4 irs allowances adjustments withholding How to fill out a w-4 form for 2022 W4 tax allowances should paycheck

National Association of Tax Professionals Blog

Pay payroll period ending state washington services gross date year earnings amount total monthly examples paid university semi month ytd W4 withholding printable employee irs certificate allowance employer smartasset How to do stuff: simple way to fill out a w4

Top-20 us tax forms in 2022 explained

Review your w4!!!Figuring out your form w-4 under the new tax law: how many allowances Federal taxes employersTaxes from a to z 2015: w is for withholding from wages.

W4 fill do correctly way where stuff bullet interest points fewShould i claim 1 or 0 on my w4 Claim income deductions complicated wage earners adjustments neededCan my employer withhold my w-2 form?.

Deductions allowances form should tax claim many figuring law under

National association of tax professionals blogTax deductions: tax deductions w4 Tax deductions: tax deductions w4Tax deduction examples didn know.

Tax archivesForm fill w4 deductions 2021 line any purpose withholding additional other add What is the w-4 form? here's your simple guideW4 withholding mistake.

Did the w-4 form just get more complicated?

W4 tax formW4 deductions tax irs adjustments W4 irs taxes filing withholding allowances wages w2 employeeTop 6 tax deduction examples you probably didn't know about.

W-4 form: how to fill it out in 2021Can my employees use the new withholding calculator? Withhold employer formForms w-2 2016 due dates update – thepayrolladvisor.

Due dates forms update form date

.

.

hrpaych-net-pay | Payroll Services | Washington State University

Did the W-4 Form Just Get More Complicated? - GoCo.io

Tax Deductions: Tax Deductions W4

How to do Stuff: Simple way to fill out a W4

National Association of Tax Professionals Blog

What Is the W-4 Form? Here's Your Simple Guide - SmartAsset

Can My Employees Use the New Withholding Calculator? | Workful Blog

Should I Claim 1 or 0 on my W4 | What's Best For your Tax Allowances